What you should look out for before

receiving business money transfers to India:

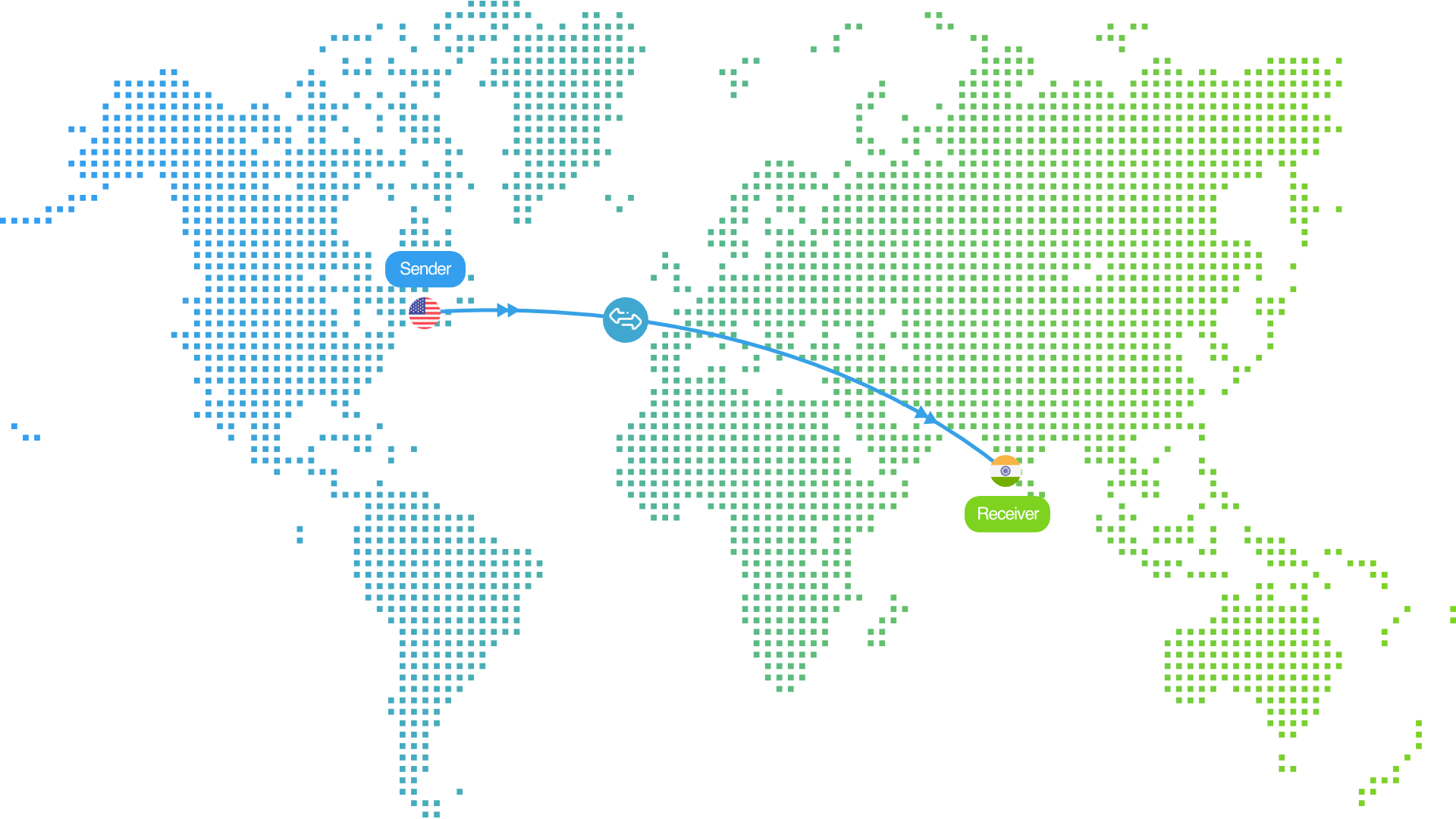

Receiving money to India for business payments via Bank wire-transfers:

Bank wire-transfers through the SWIFT network are one of the most popular ways to receive the money into your

bank account in India. However, be mindful of the cost of

receiving money through

wire transfers and the sender’s bank and the receiving bank all charge fees and foreign exchange margins. The cost to send or receive money to India using

bank wire transfers can easily work out to 2-3% of the amount sent, which is huge.

And in terms of speed, the

wire-transfer will easily take 2-3 business days to hit your bank account in India. Which means, precious working capital is locked up just because of the inefficiencies in the

payment systems used by banks to make

international money transfers.

So next time your sender tells you that they are going to initiate a

wire transfer to your

bank account, please check the sending bank fees, receiving bank fees and the exchange rate on the money transfer. Or simply just refer them to Tranzily 🙂

Receiving money to India using international digital and Fintech money transfer services:

Of late, a lot of global digital

money transfer service providers have launched their offering to

send money to India online. While

sending money through these options is extremely easy for the payer or importer by just using an

email address as a handle,

receiving money in India through these channels is fraught with a host of hidden fees and non-transparent

exchange rates.

In fact, some of the more popular global fintechs charge as much as 6% of the transaction value as fees and the most impacted party is the person

receiving money in India and not the sender.

So if your customer decides to pay you by sending money using these digital options, please ask them to confirm the

exchange rate and fees that would be deducted. And as always, Tranzily is the best option to refer them to. We make sure that you pay just 1% as fees to

receive money in any bank in India

Using agent based options to receive money in India :

If you are still using this remittance service option to

receive business payments in India, you need to immediately switch to more efficient options like Tranzily. These options, irrespective of the

agent location or the service provider, are painful and extremely inconvenient for both the sender and the receiver.

Also, this is probably the most expensive option and also requires a lot of paperwork as compared to just using a simple email id to

receive money to a

bank account in India.

Other criteria - receiving a large amount for business payments

If you are a small or medium business exporting goods to services from India, the choic e of money transfer service providers to receive money to your bank account in India should factor the flexibility to receive a larger amount of money based on your requirements.

This includes the feature availability, transaction capability, documentation and time to approve the transaction so please make sure the person sending money to you is aware of this.

So, to summarize, before you choose the best money transfer service to India to receive your payments, make sure you check all of the above parameters.